The Critical Interplay Between Commercial Receivables and Inventory in a Liquidation

In this article we take a look at how leveraging the power of inventory and a thorough understanding of retailer hold-backs can help ensure maximum return for accounts receivable during a liquidation. We also examine the importance of leveraging all asset classes in delivering maximum overall monetization value.

The economic fallout of COVID-19 across industries and sectors has been devastating since the pandemic reached the shores of the U.S. in March 2020. With varying levels of social distancing requirements in place and unemployment levels significantly elevated since that date, consumer buying power has been challenged and typical buying behaviors have been turned on end. These developments have dealt a difficult hand to retailers, as well as to suppliers and manufacturers who produce the varied goods that fill store shelves and the industrial products and equipment that help drive other areas of the economy.

Some businesses have been able to pivot quickly and adapt to the disruptive business environment, but others have lacked the innovation, nimbleness and in many cases, the balance sheet strength to withstand the decreased customer demand, supply chain disruption and other numerous challenges associated with this period. And while some manufacturers have been prepared to proactively act to protect their interests as signs of operational difficulty and potential insolvency emerged among their retail partners during the current crisis, many others have not. We are seeing the impact of that play out now across the market.

Having handled hundreds of liquidations, restructuring and other efforts on both sides of the retailer/supplier equation, we can say with absolute certainty that there are definitive steps a manufacturer can and should consider taking when a retail or wholesale partner’s insolvency is in question. These include but are not limited to efforts such as reviewing existing agreements to determine leverage in restricting certain products or quantities to limit downside risk, and structuring future orders and their delivery based on advanced cash payments. While important in their own right, and often best managed with guidance from a third party firm with appropriate expertise, these proactive steps are not the focus of this article which, instead, concentrates on the important and symbiotic relationship between a manufacturer’s inventory and receivables during a liquidation.

In the current environment, we are seeing two predominant scenarios among consumer product, industrial and other manufacturers. There are those who were either in, or headed down a likely path toward, distress in advance of the pandemic; and there are others for whom the pandemic suddenly and dramatically changed the course of their business, leading to their distress. Perhaps a company lost a few critical months of production during the early months of the COVID-19 shutdown, which prevented them from meeting their obligation to ship required product to a big box retailor in time for this year’s critical Black Friday sales. Or maybe, excessive debt and the failure of one or more of its premiere retail partners in the year leading up to the pandemic predisposed the business to insolvency during this most challenging of years. Regardless of how a company got here, the action now dictated involves an intricate and methodical process best orchestrated by those with the breadth of expertise to ensure its execution.

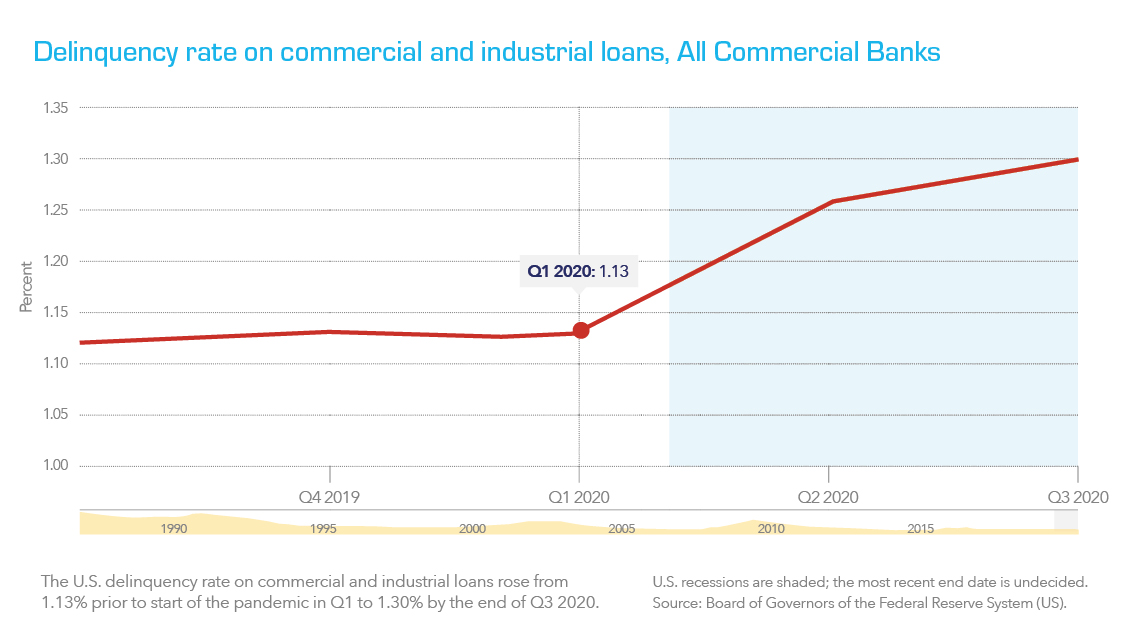

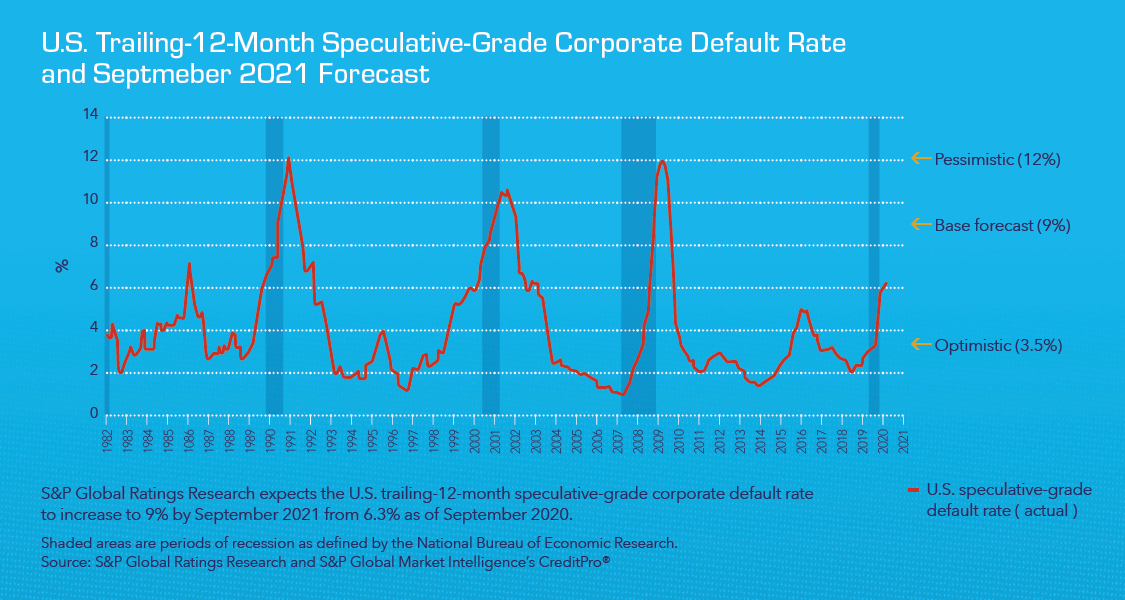

The global pandemic has disrupted the U.S. economy and triggered a wave of large corporate bankruptcies. 138 companies with over $100 million in assets filed for bankruptcy during the period Q1 through Q3 2020, as compared to 75 filings during the same period in 2019. This represents an 84 percent increase year-over-year. As compared to the comparable 2005-2019 quarterly average of 19, the totals for Q1, Q2 and Q3 during 2020 were 34, 35 and 49, respectively.

Even with a phased release of the Coronavirus vaccine beginning in earnest during the early months of the new year and the prospect of commerce returning to a more normalized state by Q3 or Q4, we expect to see further distress and another wave of restructurings and bankruptcies spiking toward the middle of 2021 as the significant debt load assumed by companies to help sustain their businesses through the pandemic comes home to roost in the face of continued operational challenges.

Businesses facing these harsh realities are well advised to engage a third party firm with demonstrated expertise not only in their specific product category, but in all asset categories across the balance sheet. Only with this breadth of knowledge and perspective can a truly comprehensive strategy be developed and properly executed to ensure maximum value is returned through monetization of a company’s distinct array of tangible and intangible assets.

Inventory & Accounts Receivable

The critical nature of the interplay between various asset classes in delivering maximum value for a distressed company can be illustrated through a look at inventories and accounts receivable. At Hilco, when evaluating and weighing the most beneficial approaches to handle the collection of receivables from a client’s existing customers, we consider numerous factors. Are there accumulations of discounts, marketing allowances, allowances for warranty claims, rebate revenue, inventory return privileges or returns for damaged products? These are all things that customers will seek to utilize, particularly in dealing with a distressed seller, when determining what they are willing to pay against those receivables. As a result, it is imperative to understand these complex and dynamic contractual stipulations in order to understand the leverage you have and best negotiate for maximum return on receivables.

When a customer is also interested in buying more inventory, which is often but not always the case, that too becomes strategically leverageable in driving collection of receivables. How much does the customer need and how fast do they need it? How important is having that inventory to their selling season? Is the item in high demand in the market? What do we know about what their competitors are carrying during the same period and the price they paid? In instances such as these, we find that having our inventory sales and receivables collection teams work jointly, both in advance to formulate a strategy, and then directly in negotiation with our client’s customers, is a highly effective path to maximizing monetization for both asset categories.

We look at the completed inventory we have on hand, how it matches up against the customer’s needs, and how can it best serve our purposes in both generating revenue and further enabling maximum collection of accounts receivable. And because the inventory on a company’s balance sheet is not always limited to product ready for sale, the potential of any of work in process inventory (WIP) must also be considered as an important part of this equation. Here it is imperative to accurately determine if any portion of the WIP can also be used as leverage to collect receivables, whether there are other potential buyers for the WIP and, lastly, whether or not it makes economic sense to undertake conversion of the WIP to product ready for sale or to tranche it off in its current state for sale.

The undertaking grows more complex from here. Does, for example, the manufacturer have the correct bill of materials to assemble the required quantity of finished goods? Depending on the product, this may include components such as motors, housings, LED panels, hoses, switches, bearings, casters, boxes and product manuals. Are certain of these components either currently, or scheduled to be, in transit from overseas and, if so, has the freight provider already been paid? If not, how much is owed and how does that amount impact the economic feasibility of the undertaking? What is the cost of labor to assemble and finish the goods and given the pandemic environment, does the manufacturer have the needed labor force on hand or will it need to hire workers for the job?

To further complicate matters, manufacturers’ various products are often designed to share interchangeable parts. In managing the WIP in such cases, additional analysis is required to determine which product or combination of products should be built based on considerations including market demand and margin, or whether the parts can yield a superior return by being sold to an individual or multiple bulk WIP buyers.

As you can perhaps begin to see more clearly through these examples, an undertaking involving these many components and variables can become quite substantial and is therefore best managed for success by a tenured monetization partner with the breadth of expertise needed to coordinate its many diverse moving parts. Beyond liquidation credentials, this requires the capability to optimize and manage a going concern capable of navigating the complexities of the WIP, leveraging overall inventory and other asset classes such as intellectual property, machinery & equipment and real estate to not only drive the collection of accounts receivable, but to maximize the overall value returned.

The earlier that a company identifies and engages a partner in this process, the better the likelihood for a desirable outcome. Experienced third party firms like Hilco can add value beginning on day one by thoroughly evaluating the status of assets and the interplay between them. Early engagement also provides for development of a strategy to maximize return through continued operation of a going concern while simultaneously preparing for a potential liquidation

The Borrowing Base

With great deference to, and respect for, our many friends in the ABL community, we feel that it is important to point out a disconnect that we are observing in current borrowing base practices. Banks lending against a company’s assets, do so based upon a borrowing base that includes inventory, receivables and other potential asset classes. For receivables, this base it is generally formulaic; typically lending at around 85% of current eligible receivables with few reserves or adjustments. But what we have experienced with some recent high profile bankruptcies in this environment is that collections on receivables are actually averaging closer to 45-55 cents on the dollar in liquidation. So, there is a significant disconnect present in terms of the standard practices for how a borrowing base has traditionally been constructed around an operating company-oriented environment, where on average only 15% of receivables are discounted vs. the realities of how receivables are now playing out in real world liquidation scenarios during COVID-19.

Contributing factors to this dynamic include some of the very same items we referenced earlier in this article, such as: 1) contractual deductions that many buyers will accumulate and plan to take at the end of a year; 2) return privileges or perceived warranty claims liability and; 3) rebate revenue which is prevalent in pharmaceuticals but tends to go “out the window” in a liquidation. Retailers may even have clauses in their contracts that entitle them to offset multiple product lines. This can result in payments of less than 50% and, in certain cases, nothing at all in a wind-down scenario.

Some retailers are contractually entitled to accumulate volume rebates over the course of the year based on volume purchase milestones. Others have warranties on shipped products that allow for deductions off accounts receivable for goods that either don’t function properly, are broken or damaged. Here, too, during a wind-down, we frequently see retailers demand deductions up to three times greater than the customary 3-5%.

In a liquidation scenario, each of these variables individually and collectively has the potential to derail an ABL’s current 85% receivables borrowing base assumptions. Understanding the intricacies of these varied retailer entitlements and knowing in advance that they are in place is, however, highly advantageous to a manufacturer/seller in the accounts receivable negotiation process, particularly when supported by a well-managed going concern capable of delivering the product and quantity a customer needs and may want badly enough to negotiate in good faith on those often-illusive payment.

Summary

Given the state of the economy, the jobless rate and the constraints and disruptions that COVID-19 continues to place on the market, we expect to see a further elevated level of bankruptcies, restructurings and associated liquidations throughout the year ahead, likely peaking in Q2 or Q3. Companies which took on additional debt to help push through the challenges of the pandemic period and those that were already in some level of distress prior to the pandemic may be among those most at risk in the coming months.

As the only firm capable of delivering a comprehensive and cohesive monetizing solution across every asset category, Hilco Global can not only effectively collect receivables and manage the conversion of WIP inventory to a finished good, we can value and sell a company’s intellectual property, equipment and real estate holdings in a timely and coordinated fashion to drive the highest value attainable. Further, while executing on these asset monetization efforts, we make sure to maintain a positive relationship with our clients’ customers to ensure that they remain as viable buyers when we manage going concern and future asset monetization transactions.

We have been working at a record pace throughout the pandemic representing the interests of many well-known companies across a multitude of industries and sectors. Most recently, we completed the monetization of more than $100 million in consumer electronics inventory and receivables and are also now operating a going concern transportation leasing firm with 4,000 semi-trucks and more than $80 million in receivables. The work we are conducting for clients and the many conversations we are having with our partners and contacts across retail and manufacturing provide us with daily insights that we welcome the opportunity to share. If you believe your business is either headed toward or is already in distress and have questions or would like to better understand your options, do not hesitate to contact us. If you are a lender and want to discuss potential exposure within your portfolio or how to approach setting aside reserves for credits to better protect your financial institution from downside risk associated with receivables in the coming year, please reach out to us as well. We are here to help during this complex period.