Underlying Economic Fundamentals Reveal Likely Recovery Path for Transportation Industry Fleet Assets

In this article we take a chronological look at industry trends leading up to the current pandemic to provide insight into both a recovery timeframe and potential valuation levels for transportation industry fleet assets in their emergence from the current COVID-19 crisis.

These are certainly unusual and unpredictable times for the transportation industry. The COVID-19 pandemic and associated response have significantly altered the operations of fleets worldwide. In the U.S., with most states’ stay-at-home and essential services restrictions continuing to be enforced, the transportation industry finds itself in uncharted territory. Disruptions in the supply chain and increased demand in certain areas such as retail food are resulting in a windfall and in many cases, stressed capacity levels for some operators. C.H. Robinson, for example, reported volume increases of 30-40% for retail food products and 15-20% percent for healthcare and produce in March. Meanwhile, freight companies with heavy concentration in retail, automotive and exposure to the shuttering of restaurants, hotels, cruise lines, sporting and concert events nationwide remain weak.

By some measures, the situation looks quite bleak in regard to the future value of transportation and construction fleet assets. For the North American market overall, data analytics and insight firm, IHS Markit forecasts a production decline of as much as 50% from 2019 production levels. This primarily reflects anticipated shifts within the U.S. truck-buying industries but also includes Canada and Mexico. And S&P Global Economics has forecast a historic annualized decline in the U.S. economy of almost 35% in the second quarter of this year, alone. Yet, taking a step back to establish a baseline from which to view the current situation and reasonably forecast a likely recovery timeframe for the industry may provide some welcome perspective on what operators and lenders can expect to occur in the second half of the year and into early 2021.

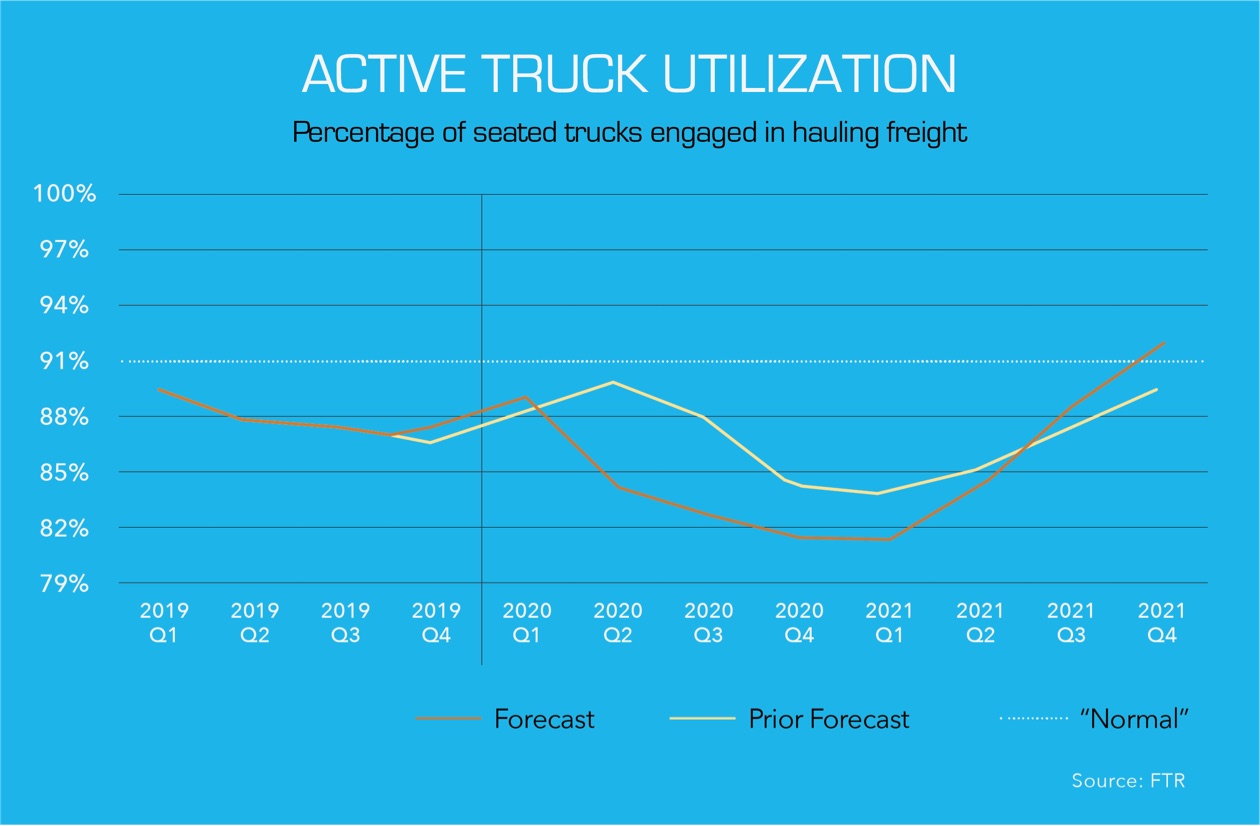

A deep decline in freight volume means significantly weaker active truck utilization than previously forecast, resulting in an even-weaker truckload rate outlook of about -4%

A Timeline Approach Suggests Where We Go From Here

2016 – 2018

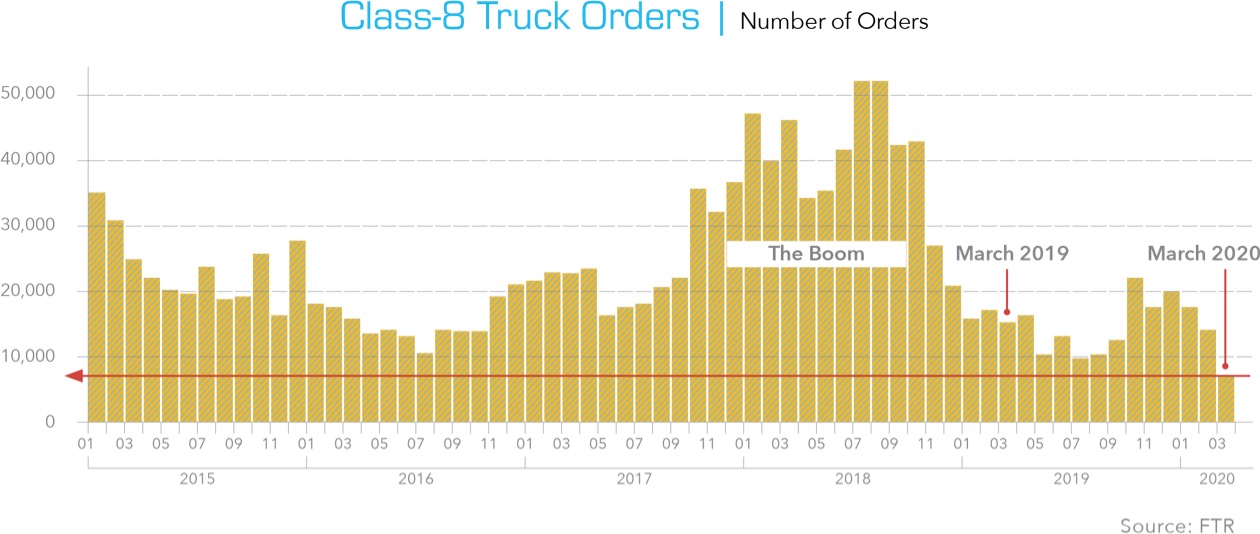

Beginning in 2016, the Class A Transportation world embarked on a tremendously prosperous run, setting all-time highs. During the period 2016-2018, OEM production, resale and auction market values accelerated, reaching levels never before seen in the 40+ year lifetime of modern trucking in America. Production and used equipment availability during this timeframe were not able to keep pace with demand in North America, which resulted in a significant quantity of trucks of varied ages selling at a true premium. Calendar year 2018 represented the zenith of this phenomenon.

2019 – Late February 2020

Going into 2019, there were already economic signs, including projections on freight import and export that indicated the likelihood of a flattening in the market for the year. It is important to keep in mind that relative to the extreme highs reached in 2018, even a “flat” year at that point was considered as an extremely good outlook from a historical perspective. For us at Hilco and others who work extensively and are tuned-into the nuances of the industry, this flattening was expected, but many other industry participants and those who do not regularly track the technical analytics or metrics of transportation were caught off guard by the market adjustment that occurred throughout 2019.

As the market corrected that year, one of the most notable things that occurred in the public auction world was that trucks aged 1-5 years old began to show softness from a resale value perspective. Instead of the typical 10-12% depreciation, we suddenly started to see gaps of 20% to 25% between, for example, a 2017 model and its 2018 counterpart which was virtually identical in all respects. At Hilco, based on our early observation of this new wrinkle in the market, we began to advise many of our fleet lenders and clients that this was taking place. This, then was factored into the many appraisals we delivered that year – particularly those conducted in the back half of 2019 – to more accurately reflect the larger value gaps that existed between production years. Historically, however, it should be noted that there has been tremendous stability in auction sale prices over time. In fact, according to ACT Research: In 2009 during the middle of the Great Recession the average auction sale price of a Class 8 truck was $18,167/unit with an average age of 8 years and 485,000 miles p/unit utilization. Compare that to the average price over the last decade of $18,828/unit with an average age of 10 years and 459,900 miles, and the numbers don’t lie. The trucking industry has experienced its ups and downs but has been extraordinarily consistent over the course of the

last decade.

Even with this depreciation gap development, 2019 was a very good year; it just wasn’t the breakout year that 2018 was. And so, entering into the first quarter of 2020, all indications were that sales volume in the public auction markets would be steady. And, in fact, we observed that steady demand and buying appetite for these trucks, which held true until late February when the COVID-19 pandemic first came onto the radar screen of the industry in the U.S.

Late February 2020 – Q2 2020

First quarter of 2020 looked strong until COVID-19. In March, even with the onset of related actions in the U.S., regularly scheduled public auctions were still conducted. Though we generally saw those deliver an approximately 5% reduction in gross value for transportation and construction assets, with some limited pockets of 10% reduction, in general the buying base was still there, still active and seemingly not afraid to spend money in this unprecedented environment; even given that such a high degree of commerce was either already restricted or shut down altogether. Notably, Ritchie Bros., which operates the largest daily online marketplace for heavy construction and commercial transportation assets, reports that an average of 78% of its buying base in all auctions have been to online buyers in Q1 of 2020. It seems that buyers are already comfortable purchasing this class of assets electronically as long as they have confidence in the vehicle information provided.

While auction values remained relatively high in March, orders for heavy trucks collapsed by 52% from already low levels of a year prior to 7,400 trucks, the lowest since 2010.

While we have not seen the alarmingly dramatic material drop in realization at auction that some might have expected, there are no metric precedents that can tell us what will happen in the weeks and months ahead. That said, based on Hilco’s own market intelligence and ongoing engagement with our many customers and partners across the supply chain throughout this crisis, we do expect to see a trough develop in the resale marketplace during May 2020. We believe this will likely occur as potential buyers, faced with the very real economic ramifications of the period that we have experienced since the start of the crisis, may not have either the capital needed for those expenditures or the confidence to dive-in and buy-up excess inventory of these assets. And from a freight logistics perspective, we do also expect to see some areas experience an ongoing lagging effect from the Wuhan and other regions of China and the products they create there, due to continued delays at the ports on both coasts of the country.

Conclusions

We view what we are currently experiencing in the market as a pandemic-driven anomaly, rather than an outcome based on any actual underlying weaknesses in the North American or the U.S. economy/marketplace itself. From everything we are seeing, we believe the U.S. economy is still fundamentally sound, in stark contrast to the mortgage default-driven collapse and ensuing financial crisis of 2008. Factoring this alongside the strong industry start we observed in the first two months of 2020 prior to the COVID-19 pandemic, which saw performance tracking along the trend line it followed throughout much of 2019, we expect to see an moderate bounce-back and a gradual return relative to normalized levels beginning in late Q3 of this year and continuing into Q1 of 2021.

Recommendations

At this time Hilco cautions against creditors taking action on any forced liquidations for transportation or construction fleets that would require realization within the coming 4 – 6 months. In the event, however, that there is a need to assume control of certain fleet assets, you should be prepared to hold them for a period of time that may extend to the end of 2020 or into early 2021 to ensure a market capable of absorbing those vehicles to realize a reasonable liquidation value. Monitoring collateral with more frequency in the near term is critical toward understanding this evolving situation and the potential impacts on your borrowing base. For ABLs with concerns pertaining to specific exposure within their portfolio at this time, we are here to help and encourage you to reach out to us for guidance. We are having many such conversations and are able to discuss current values relative to fleets, and how that relates to expectations as we climb out of the current shutdown.