Fall 2022 Wholesale Horticulture/Nursery Industry Update

In this article we take a look at the unique nature and developments in the wholesale horticulture/nursery industry, and in particular among larger growers. We discuss the path the industry has taken in recent years as well as current trends and recommended key monitoring considerations for existing and prospective asset-based lenders to the industry.

THE WHOLESALE SEGMENT

Wholesale nurseries grow and sell a wide variety of plants for transplanting, budding, grafting or layering. They provide stocks for restoration, wetland mitigation and conservation, environmental landscaping, and for the beautiful gardens found among innumerable homes, businesses, parks and myriad other landscapes. The wholesale nursery industry is highly competitive. Competition is based principally on product quality, breadth and uniqueness of product offerings, customer service and prices.

Larger wholesale growers and sellers deal in high volumes of live bedding plants, shrubs, flowering potted plants, ground cover, and trees (e.g. citrus and fresh cut Christmas trees). These growers also may focus on certain segments, such as only growing annuals or perennials. Some also provide retail customers with a broad array of value-added services, such as in-store merchandising, product display and maintenance, promotional planning and product reordering. The primary customers of these larger growers and sellers are home centers, mass merchants, independent garden centers, and commercial landscapers.

UPS AND DOWNS THROUGH RECENT YEARS

The U.S. nursery industry is notably impacted by construction levels and general financial health in the country. As such, there have been numerous peaks and valleys through recent years.

The Great Recession and Housing Crash of 2008 and 2009

The significant slowdown in home and business construction, financial lending woes and a depressed national economy associated with this unprecedented period collectively caused nursery sales to decline significantly. For many nurseries, this meant providing substantial price discounting of mature plants and experiencing notably higher scrap levels due to the lack of sales, both which negatively impacted margins. For the majority of those that survived the downturn, a focus on both improving sales forecasting and aligning inventory plantings levels have since been implemented.

With less disposable income flowing from homeowners during that time, there was a sales trend toward more affordable, smaller size plantings. The realities of the recession also had the effect of making consumers more accustomed to seeing discounted pricing on horticulture, lawn and garden products, as wholesalers and retailers were forced to offer up deep discounts to move inventory. As with a host of other goods, it took a while after the recession to break the cycle. As demand improved, inventory availability lessened, new plant varieties were introduced, and consumer expectations — along with prices paid — normalized. Still wary from the experience, many nurseries avoided the temptation to increase plantings too much.

The Pandemic

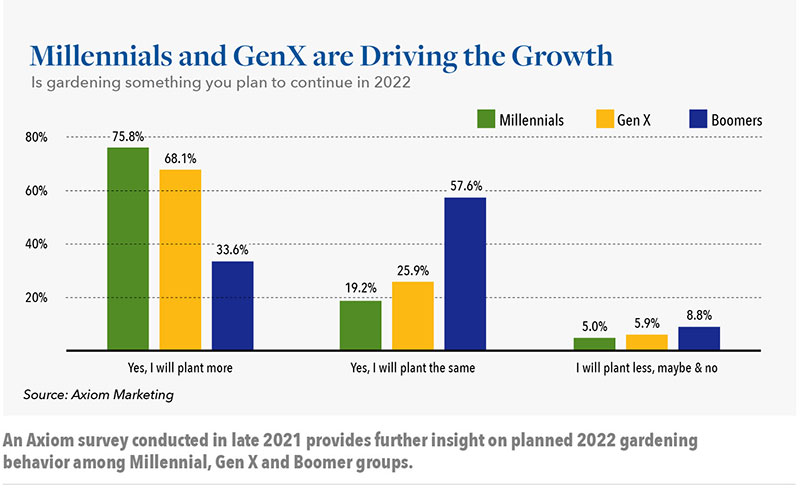

Following the initial impacts from pandemic and its lockdowns, strong home sales and homeowner demand for gardening products contributed to strong industry growth. By some estimates, the pandemic created over 18 million new consumer gardeners, many in the millennial age range. Overall, contributing factors included the fact that people simply found themselves with more free time, disposable income and daily access to outdoor space. A study of independent garden centers by Garden Center magazine found that from 2020 to 2021, there was especially strong growth among younger customer demographics. U.S. and Canadian garden centers experienced a 65% increase in millennial customer demographics and a 44% increase from Gen Z. Prior to the pandemic, Americans spent 87% of their time indoors, 6% in automobiles, but only 7% outdoors. During the pandemic, however, this changed dramatically.

In terms of consumer gardeners, specifically, the National Gardening Association’s 2021 study revealed that 42% of respondents increased their gardening activities due to the Covid pandemic, while only 9% gardened less. The data showed that the increase was mostly due to the availability of more free time for outdoor activity overall, stemming from factors including less time spent in a vehicle driving to and from work. And it appears to have rubbed off, with 30% indicating their intention to increase those activities in the future and 59% intending to keep the level of activity at the same level.

Still, as referenced earlier, growers have remained cautious about increasing planting levels too much, even though demand has been strong. As a result, in the current, potentially recessionary environment, where the pace of construction has slowed and the cost of gas and groceries is decreasing consumer disposable income, the industry is likely better prepared than it has been in the past to weather any potential storm.

TRENDS

Retail Distribution Channel

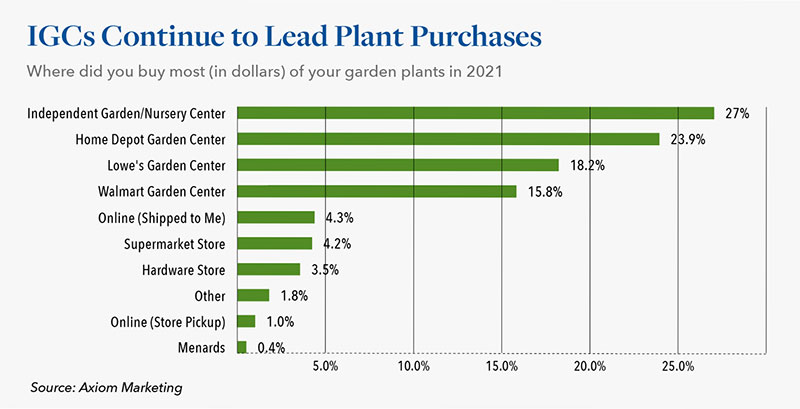

In recent years, the live plant market has demonstrated consistent growth. The retail distribution channel has consolidated significantly over the last 20+ years, with sales shifting from local independent nurseries to large home centers and mass merchants, such as Home Depot, Lowe’s, Walmart, Costco and Target. Moreover, the relatively low price of most live plants encourages impulse buying by consumers. Retail consolidation has altered the nature of the wholesale demand for live plants. Given the sophistication, size and geographic diversity of the national chains, retail customers prefer suppliers that can meet demanding delivery schedules, fulfill large volume requirements and provide a variety of value-added services. Despite this consolidation, the wholesale nursery industry is still highly fragmented and characterized by a large number of local independent nurseries.

Ecommerce

While the industry overall was not an early adopter of online purchasing, growers, nurseries and retailers have been expanding the use of ecommerce in recent years, and in particular since the start of the pandemic. End users can now order plants from some growers online and pick them up at a participating independent nursery. The program gives nurseries an opportunity to sell additional products to customers picking up ecommerce orders. While, overall, this still accounts for a small percentage of sales, the trend is gaining traction and that is expected to grow.

Imports

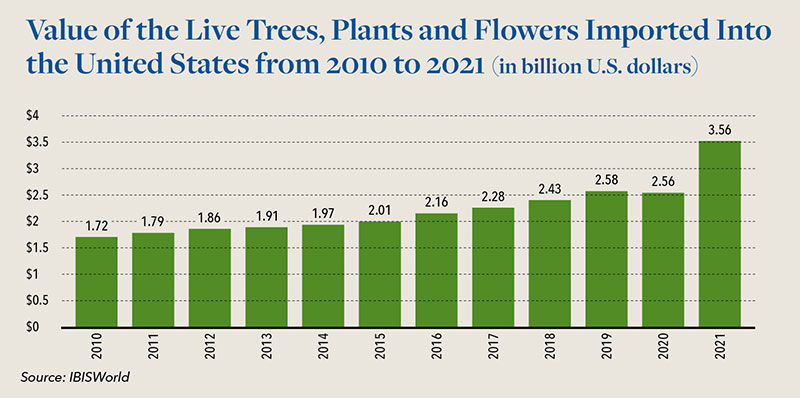

According to IBISWorld market research, there has been a notable increase in live tree, plant and flower importation to the United States over the past decade. In 2011, those imports were valued at approximately $1.79 billion but grew to over $3.5 billion by 2021.

Automation at Nurseries

Spurred on in part by increasing labor costs, but also by the need to improve the quality control of plants, we have seen an increase in automation being implemented at many of the larger nurseries. Mechanized transfer of plants to larger size cans, as well as spacing and pruning of plants are examples. Among other benefits, this is also allowing for greater speed and improved safety across repetitive tasks as well as improved consistency and quality controls processes.

FACTORS DISTINCT TO THE INDUSTRY

Living and Growing Product The unique nature of the inventory being “living and growing” means the health of the plants/trees is subject to weather conditions, pests/potential disease, and the requirements of continuous proper maintenance and watering. The handling of perishable products often requires the nurseries to sell to customers on a “right now” basis.

Forecasting

For growers, forecasts are utilized, both based on key customers and internal estimations. If sales forecasts are overly aggressive, the grower runs the risk of carrying unsold mature crops (not an option for all plants) into the next year or requiring the crops to be scrapped. Further, adverse weather conditions could delay the start of a selling season, which would affect the crops and consumer buying patterns significantly. While some plants have a short grow cycle, many can take a number of years to reach maturity. Forecasting planting levels to coincide with sales expectations is a challenge every grower faces.

Sales Seasonality

The horticulture business is highly seasonal and varies by region. Sales fluctuate by growing season and demand from residential and commercial landscapers, as well as the do-it-yourself retail segment. The higher selling period often coincides with the spring months. Depending on the horticulture items being grown, there can also be active sales in the fall and other times of the year.

LENDER MONITORING CONSIDERATIONS

Asset based lenders with horticulture and nursery businesses in their portfolios should be obtaining certain key company financial data on a periodic basis to monitor relevant business trends. For effective ongoing review, it is necessary to understand changes in metrics such as sales, gross margins, inventory levels, turnover, product mix, and customer base. The below provides additional details on some of the topline considerations and monitoring points we advise.

Costing Methodology

It is important for lenders to understand the inventory costing methodology being utilized, such as pooled costs and standard costs. The pooled cost method is common in the wholesale nursery industry. Under this system, a particular inventory item is assigned an EQU based on container size. For example, a plant in a one-gallon container is equal to 1.000 unit, while a plant in a threegallon container is equal to 3.899 units. This allows the Company to allocate pooled costs to a particular item based on the total number of EQUs. In general, a one-gallon plant requires less water, fertilizer, and labor than a five-gallon plant. With standard costs, plant types have a bill of material where standard overhead — based on maturity, species, and size — is allocated and applied to a given plant along with associated labor.

Communications during the year should be maintained between a lender and grower, to avoid surprise financial outcomes at the end of the fiscal year, due to, for example, significantly higher costs, higher levels or scrap, and lower sales than planned.

Inventory Controls and Scrap Rates

With the living nature of the inventory, it is import for lenders to be comfortable with a company’s continuous program of properly monitoring the quality and health of its plants. The health of inventory is subject to proper watering and maintenance, preparations for adverse weather conditions, and pest control. While some growers conduct a complete count of the plants at yearend, others conduct counts under a formalized cycle count program. Due to the nature of the industry, scrap occurs at all nurseries. Scrap levels should be tracked by a company and levels monitored. While higher than normal scrap levels can be due to an adverse weather event, these can also be reflective of excess inventory which was not able to be sold.

Product Margin

Product margin rates should be monitored as well. A substantial percentage of growers’ mature crops, especially during the high selling period, should be expected to be sold to the existing customer base. Declines in margin could be the result of an increase in cost per unit, or higher customer discounting. Lenders should monitor the cost per unit, as increases could indicate future margin declines associated with mature inventory carried over to the next season which was not planned by the nursery.

Additionally, input costs of labor, materials and fuel have increased notably in recent years, and in particular over the past year. Employee retention and hiring has been particularly challenging since the onset of the pandemic, which has necessitated wage increases in various geographies.

Pay by scan

Some growers sell to retailers via a pay-by-scan system. This is a form of risk transference from retailers to suppliers (growers), as growers are only paid based on the merchandise sold at the stores and bear responsibility for any scrap/shrinkage. As such, how well plant quality is maintained at the retailers will directly impact funds paid to associated growers. With this business practice becoming more widely assimilated into business practices, lenders should look for and monitor a company’s shrink rate experienced via pay by scan.

Regulation

Lenders should note that growers are subject to federal, state and local health and safety laws and regulations regarding the production, storage and transportation of certain products and the disposal of waste. Certain grower operations and activities, such as water runoff from its production facilities and the use of certain pesticides are subject to regulation by the EPA and similar state and local agencies.

Seasonal Advance Rate

With highly seasonal inventory, Hilco recommends lenders provide separate advancement rates, one in conjunction with the lower selling period and one with the higher selling period. The higher selling period would achieve greater recoveries, as it would have a more significant percentage of mature crops to be sold to existing customers and would limit a customer’s ability to find alternate sources in a short period of time.

Lenders should be cognizant of the risks associate with the low selling period as well. In the event of liquidation, the low selling period may necessitate a “back-loaded” sale strategy. During the sale period, a nursery would require the necessary capital for labor, occupancy, and crop maintenance over a longer period of time. Related expenses would outweigh sales during the first part of the liquidation. As the business moves closer to the high selling period and the crop matures, sales would increase and outweigh expenses. In this case, the Lender would be extending additional capital during this lengthened sale, and the company’s customers would have more time to find alternate suppliers. It will be important to maintain trained personnel to properly maintain (i.e., water, fertilize, prune, and space) the crop throughout the period. In liquidations of perishable plants, we have seen companies experience reduced focus and attention to maintenance, contributing to an accelerated degree of plant loss. Appraisals, therefore, should reflect an understanding that expenses would be incurred for both product maintenance and to minimize product loss, as well as all other associated costs, in event of a liquidation.

We encourage lenders with horticultural and nursery businesses within their portfolios to contact our team at Hilco Valuation Services to answer any questions you may have regarding current challenges or expected developments that those businesses may be facing.

Hilco Global, through its overall deal count volume and diversified platform of business verticals, conducts thousands of hours of senior executive conversations each month with borrowers. These management conversations provide a wealth of knowledge with up to the minute insights on the constantly changing market environment, which Hilco is then able to pass along to its clients. We are here to help our lending clients and borrowers leverage Hilco’s collective knowledge base to make critical and informed lending decisions.